Here’s a summary of the article:

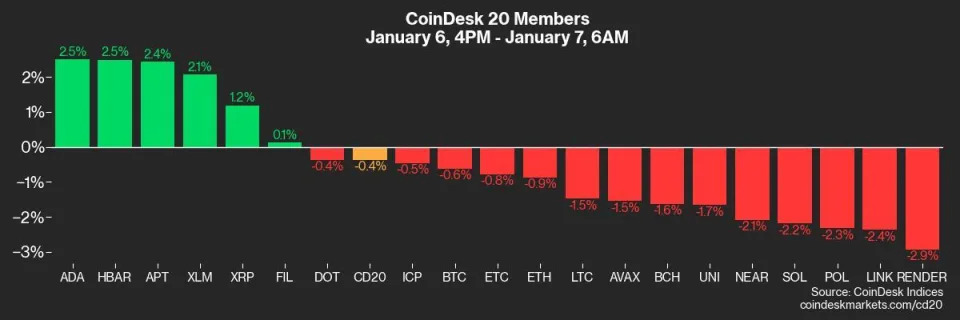

Crypto Market

- Bitcoin price: $102,000

- Ethereum to Bitcoin ratio: 0.036

- Hashrate: 792 EH/s

- Total fees: 6.6 BTC ($665,000)

- CME Futures Open Interest: 495,641 BTC

ETF Flows

- Spot BTC ETFs: Daily net flow of $978.6 million, cumulative net flows of $36.89 billion

- Spot ETH ETFs: Daily net flow of $128.7 million, cumulative net flows of $2.77 billion

News

- FTX EU Sold to Backpack Exchange, Plans Regulated Crypto Derivatives Push Across Europe

- Dollar Edges Toward One-Week Low as Market Ponders Trump Tariffs

- Canada Tilts Right as Inflation Claims Trudeau as Latest Victim

- Bitcoin Miners Stockpile Coins to Ride Out Profit Squeeze

- This Crypto Fund Blew Past Bitcoin’s 121% Price Gain in 2024

Technical Analysis

- The chart shows ether’s $4,000 call is now the most popular option on Deribit, with an open interest of $336 million.

- Note the activity in higher strike calls at $10,000 and $15,000.

Stocks

- MicroStrategy (MSTR): closed at $379.09 (+11.61%)

- Coinbase Global (COIN): closed at $287.76 (+6.32%)

- Galaxy Digital Holdings (GLXY): closed at C$29.83 (+1.32%)

- MARA Holdings (MARA): closed at $20.55 (+4.63%)

- Riot Platforms (RIOT): closed at $12.89 (+4.46%)

Funds

- Pythagoras’ Alpha Long Biased Strategy outperformed bitcoin’s 121% gain in 2024 by combining a core bitcoin position for long-term growth with machine-learning-driven momentum and long-short strategies, achieving a 204% return.

Let me know if you’d like me to expand on any of these points!