[New York, NY] – Notabene, a leading crypto compliance SaaS startup, has secured $10.2 million in Series A funding. The investment was co-led by F-Prime Capital and Jump Capital, with participation from new investors including Luno, Bitso, Blockfi, Gemini Frontier Fund, Illuminate Financial, CMT Digital, Fenbushi Capital, and ComplyAdvantage CEO Charlie Delingpole.

Series A Funding Brings Notabene’s Valuation to $45 Million

The Series A funding round brings Notabene’s valuation to a significant $45 million. This milestone is a testament to the company’s growth and commitment to providing innovative solutions for crypto compliance. The investment will be used to scale Notabene’s technology, supporting an influx of new customers.

Notabene’s Software Helps Crypto Exchanges Comply with FATF ‘Travel Rule’

Notabene’s software helps its 50-plus customers, many of which are crypto exchanges, comply with the Financial Action Task Force (FATF) ‘travel rule’. The travel rule requires crypto exchanges in FATF member countries to exchange customer-identifying information for transfers above $1,000. This is done to ensure compliance with know-your-customer (KYC) and anti-money laundering (AML) regulations.

Notabene Fills a Need for Crypto Exchanges

Notabene fills a critical need in the crypto industry by providing technology that enables the transfer of information between parties in a transaction while preserving user privacy. The identify-verification process requires anonymous wallet addresses on the blockchain to be linked to real-world customers. Notabene CEO Pelle Brændgaard emphasizes the importance of ensuring this information is only seen by the parties involved in the transaction and Notabene itself.

Identity-Verification Services Build Trust between Consumers

Beyond ensuring compliance, Notabene’s identity-verification services help build trust between consumers transacting in crypto. This is particularly important for transactions involving anonymous wallet addresses on the blockchain. By linking these addresses to real-world customers, Notabene helps mitigate the risk of fraud and ensures that consumers are transacting with the correct counterparty.

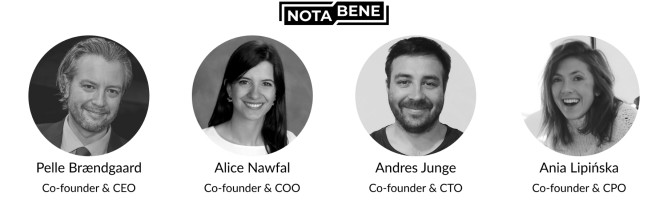

Notabene’s Founding Team and Employees Come from Decentralized Identity Startup UPort

Notabène’s founding team and many of its early employees came from decentralized identity startup UPort. This experience has been invaluable in shaping Notabene’s approach to crypto compliance and identity verification.

F-Prime Capital and Jump Capital Lead Series A Funding Round

F-Prime Capital and Jump Capital led the Series A funding round, with participation from new investors including Luno, Bitso, Blockfi, Gemini Frontier Fund, Illuminate Financial, CMT Digital, Fenbushi Capital, and ComplyAdvantage CEO Charlie Delingpole.

Notabene’s Solution for Crypto Compliance

Notabene’s solution is a critical component of the crypto ecosystem. By providing a secure and reliable way to exchange customer-identifying information, Notabene helps ensure compliance with FATF regulations. This, in turn, builds trust between consumers and increases confidence in the stability and security of the crypto market.

Future Plans for Notabene

The Series A funding will be used to scale Notabene’s technology, supporting an influx of new customers. With this investment, Notabene is poised to become a leader in the crypto compliance space. The company plans to continue innovating and expanding its offerings to meet the evolving needs of the crypto industry.

Conclusion

Notabene’s $10.2 million Series A funding round is a testament to the company’s growth and commitment to providing innovative solutions for crypto compliance. With this investment, Notabene is well-positioned to become a leader in the crypto compliance space. The company’s focus on identity verification and FATF ‘travel rule’ compliance will help build trust between consumers and increase confidence in the stability and security of the crypto market.

Related Articles: