The US markets are currently experiencing a tech-led rally, with the S&P 500 and Nasdaq Composite posting gains. Investors are keenly observing growth companies that combine robust potential with strong insider ownership. Identifying stocks where insiders hold significant stakes can be indicative of confidence in the company’s future prospects, aligning well with current market enthusiasm for innovation-driven sectors.

Name | Insider Ownership | Earnings Growth

———|———————-|——————-

- Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.7%

- Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3%

- Clene (NasdaqCM:CLNN) | 21.6% | 59.1%

- EHang Holdings (NasdaqGM:EH) | 31.4% | 79.6%

- BBB Foods (NYSE:TBBB) | 22.9% | 40.7%

- Credo Technology Group Holding (NasdaqGS:CRDO) | 13.3% | 66.3%

- Credit Acceptance (NasdaqGS:CACC) | 14.1% | 49%

- Capital Bancorp (NasdaqGS:CBNK) | 31.1% | 30.1%

- Corcept Therapeutics (NasdaqCM:CORT) | 11.6% | 34.7%

- Ryan Specialty Holdings (NYSE:RYAN) | 16.8% | 36.4%

Click here to see the full list of 198 stocks from our Fast Growing US Companies With High Insider Ownership screener.

Let’s dive into some prime choices out of the screener.

1. Roku

Overview

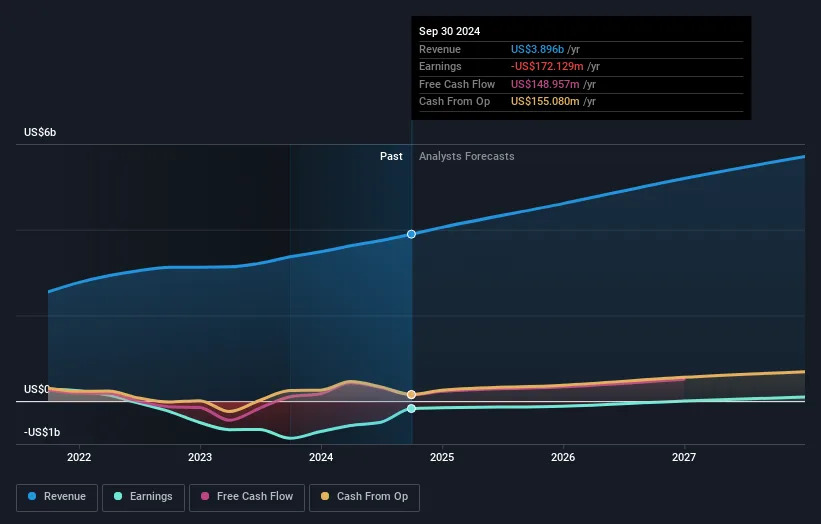

Roku, Inc., along with its subsidiaries, operates a TV streaming platform both in the United States and internationally, with a market cap of approximately $11.24 billion.

Operations

The company’s revenue is primarily generated through its Platform segment, which accounts for $3.32 billion, and its Devices segment, contributing $579.97 million.

Insider Ownership

12.3%

Roku’s growth prospects are underscored by its forecasted revenue increase of 10.8% per year, surpassing the US market average, and anticipated profitability within three years. Recent product launches, such as the QLED CHiQ series, have contributed to the company’s momentum.

Analysis

Trading below estimated fair value and with a low debt-to-equity ratio, Roku presents an attractive opportunity for investors seeking growth at a reasonable price.

2. Sea Limited

Overview

Sea Limited is a Singapore-based technology company that operates e-commerce platforms, digital payment services, and online gaming services in Southeast Asia and Latin America, with a market cap of approximately $110 billion.

Operations

The company’s revenue is primarily generated through its Shopee e-commerce platform, which accounts for the majority of its sales. Sea also offers a range of digital payments and financial services.

Insider Ownership

12.1%

Sea’s growth prospects are underscored by its forecasted revenue increase of 35% per year, surpassing the US market average.